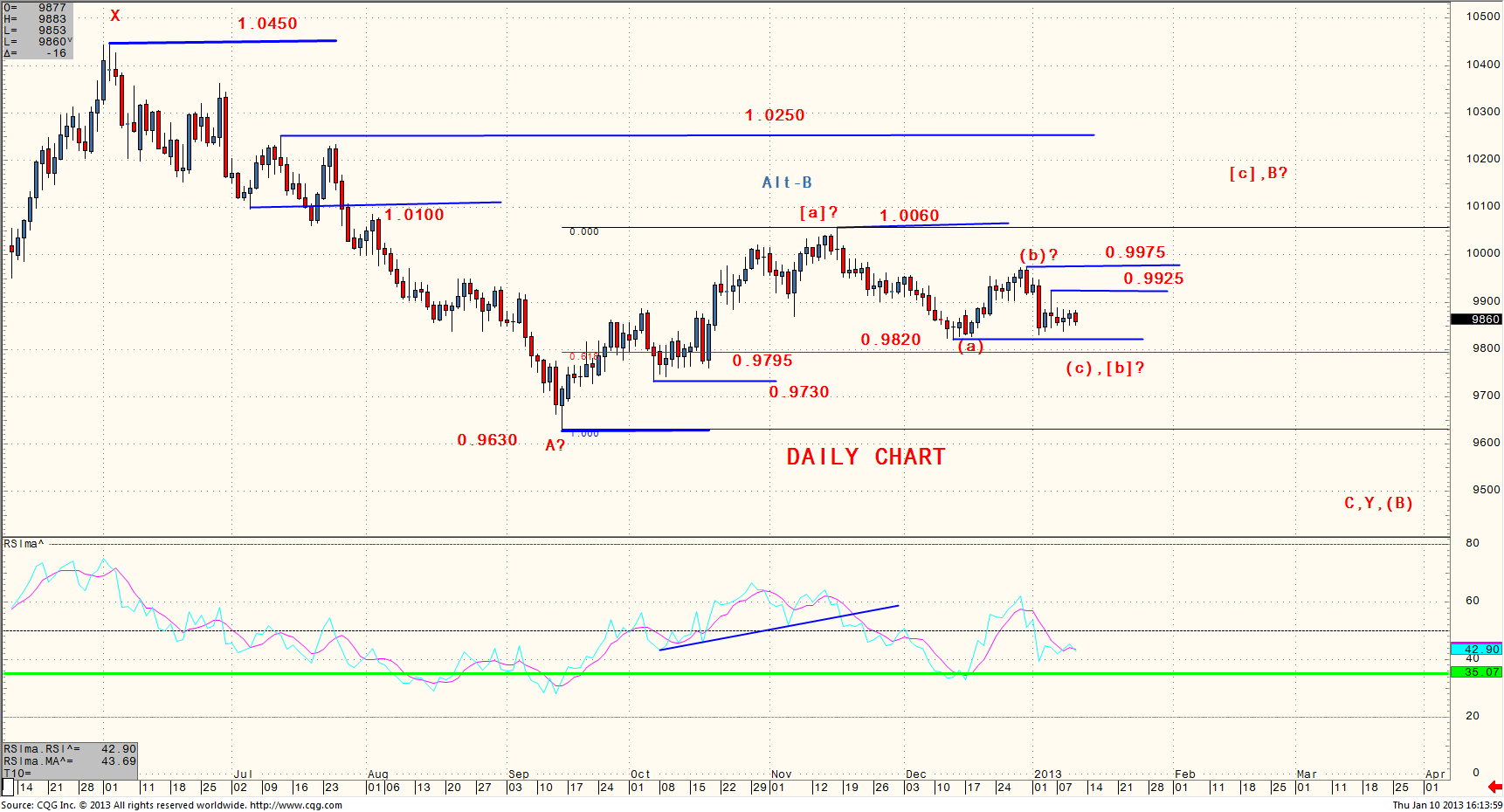

A larger corrective trend started from 0.9405 (July’11 low) appears to be still in force which may be a flat corrective wave. A retest of the 1.0510/1.0655 resistance on multi-month basis is possible. The medium-term setback from 1.0450 (June’12 high) has the potential to retest the major swing low at 0.9405. A reversal above 1.0250 would refocus on 1.0450 ahead of 1.0510. A break below 0.9405, however, targets 0.9300/0.9060 next.

A wave [b] pullback is underway from 1.0060 (Nov’12 high) and the correction appears to be closer to its completion. A break below 0.9820 would test the 0.9795/0.9730 support where bulls are likely to renew corrective uptrend. A reversal above 0.9925/0.9975 signals the start of wave [c] and aims for 1.0020/1.0060 initially ahead of the tough 1.0100/1.0250 resistance. A break below 0.9730, however, refocuses on 0.9630.